Overall, the spot market demand for major brands remains mostly weak and in an overall downturn. Some Automotive Grade components still maintain a high demand trend:

TI:Low demand and high inventory levels

The demand for TI is still very low. Its factory inventory will basically meet this year's production demand. Most chip delivery cycles have been restored to 6-8 weeks.

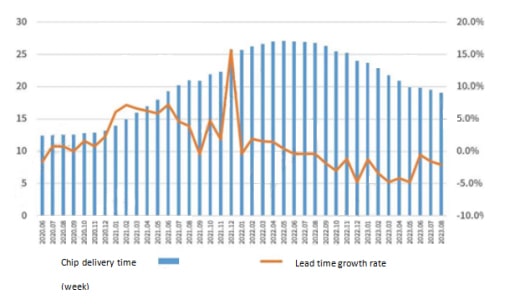

TI's overall inventory level is currently high. Especially for general PMIC, the inventory turnover days have reached over 200 days. DSP is currently approaching 190 days, and it is expected that the inventory level will remain high in the second half of the year. In the coming months, the TI spot market will still be difficult to endure. Some factories are trying to find opportunities for long-term orders to reduce costs. It is reported that automobile and industrial machinery manufacturers contribute over 60% of Texas Instruments' revenue. According to the latest forecast, some industrial machinery manufacturers' customers are slowing down, just like computer and mobile phone manufacturers. At present, only the automotive market remains strong in demand. Texas Instruments stated that overall, as the quarter progresses, the order situation is deteriorating. The number of cancellations of orders is increasing. Although Texas Instruments claims that the demand for chips in the automotive industry is still strong, Summit Insights Group analyst Kinghai Chan points out that many automakers have ordered twice as many chips as needed. And it is expected that the demand for automotive chips will slide to pre pandemic levels in the first half of next year. At present, the delivery time of TI has been shortened for five consecutive months. Most customers have received messages of shortened delivery times. Among them, the lead time of power management chips and analog chips has decreased the most. According to comprehensive big data, the TLV702 series has been quite popular in the past two weeks, and there has been a slight increase in prices.

ADI:Low demand, some prices are upside down

The demand for ADI is still sluggish, and there is sufficient stock of general materials, resulting in some material market prices being inverted. ADI's industrial control, medical, and automotive materials are still out of stock. For example, LTC6810HG-1 # 3ZZPBF has a delivery time of 52 weeks and a high spot price.

The delivery cycle for ADI general materials has returned to 13 weeks. The delivery cycle for some out of stock materials is over 30 weeks. For example, LTC2415-1IGN # PBF, the current delivery time is still 33 weeks.

NXP:The supply of industrial and automotive grade components is in short supply.

The overall demand for NXP is weak. Supply chain news shows that the price trend of most products is stable and has decreased. For example, the best-selling product MK64FN1xxx has dropped in price from its peak of $400-500 last year to around $40-50 now. There are also some industrial and automotive materials, although the delivery cycle has improved, there are still some parts in short supply. Products with relatively high popularity such as MC52xxx and S912ZVxxx. The gap between the K142xxx and K144xxx of the automotive general MCU FS32 series has been significantly reduced. Some products are still in demand, such as the Kinetics K series.

German automaker Volkswagen recently said in order to avoid ship supply shortages, they begun sourcing important chips directly from 10 manufacturers, including NXP, Infineon and Renesas Electronics. In response to the continued tight supply chain capacity, NXP has established the NCNR (non-cancelable non-returnable) system to help automakers and Tier 1 (Tier 1 supplier) companies make reasonable capacity allocations. According to the current and 2023 NCNR order level, NXP's current production capacity can cover 80% of the order demand, which makes the company full of confident about the long-term market outlook.

It is reported that the automotive chip is structural, rather than a comprehensive shortage, some products inventory pressure has quietly spread, but the power semiconductor and MCU is still relatively tight, IDM large manufacturers of automotive IGBT delivery are still more than 50 weeks.

Microchip: weak demands, stabilizing spot prices

Overall demand for Microchip is very weak, with low demand from OEM/EMS vendors, who are now more focused on lead time and cost saving strategies. 8-bit and 16-bit MCU product lead times have basically returned to 12-30 weeks, and supply side inventory is well stocked. Spot market prices will stabilize.

Infineon: IGBT still stockout, supply-side MOSFET inventories under pressure

Recently, Infineon announced to raise revenue and profit targets, revenue growth from 9% of the previous value to more than 10%, profit margins are expected to increase from 19% to 25%. It seems to confirm the recent Infineon intends to raise the automotive chip offer. According reported that Infineon plans to raise the price of industrial and automotive components in Q4 of this year, consumer components price will not increase, but the industrial components will rise by 10%, and the automotive components will rise by 20%.

For MOSFETs, there are also large inventories on the open market, but overall demand is weak. Some low-voltage models have seen market prices inverted, such as IRF250NPB and IRF2804PBE, and some high-voltage MOSFETs remain at high prices.

At present, Infineon's a variety of industrial control class chip, IGBT supply is still very tight, of which the IGBT's Q4 delivery period reached 39-50 weeks. According to industry insiders, automotive IGBT supply and demand gap of 50% has become the consensus of many suppliers. At present, the automotive IGBT demand exceeds supply, delivery pressure, orders on hand have been scheduled to the end of this year or even next year. In order to meet the growing demand, Infineon plans to expand production capacity, its semiconductor plant in Austria was completed last year.

Renesas: Prices still trending down

During the first half of the year, Renesas' prices continued to trend downwards. The current market demand for automotive MCUs, analog and power devices remains high. In the future, there is still a large market for chips related to new energy vehicles. For its part, Renesas is also currently increasing its funding and technological research in this area and has won the No. 1 share of the automotive MCU market in 2022, which means that the target group for consuming these types of ICs will grow.

Recently, clients have focused on MCUs, CLKs, memory and power management. Microcontrollers can be in short supply, as are the R5S, R5F, R7F, UPD - prefixes, and at higher prices. the HD64 and UPD series have been stopped production. For power management, trading volume is relatively high and prices are stable, with some suppliers clearing out at a loss. The original IDT and ICS series CLKs and controllers are more expensive. Power management is a popular device with relatively large market volume. Renesas is also focusing on the AI side.

Qualcomm: Still very weak demands, price war continues to Q4

Demand for Qualcomm is still very low, and clients continue to wait. Netcom materials IPQ-4019 and QCA-8075 are released in stock, and prices have dropped compared with the previous period. The supply of consumer products is saturated, and most of them are in stock at present, and the prices of CSR8670 and CSR8675 series are stable.

Following Qualcomm layoffs, the industry rumors, in order to stimulate customer willingness to pull goods and speed up the clearance of inventory, Qualcomm recently launched a price war, locking the low-end 5G cell phone chip, and the degree of price cuts, "quite a sense", as high as one to two percent, it is expected that this wave of price cuts by Qualcomm measures will continue to Q4, MediaTek prepared for war.

Xilinx: Low demand, gradual recovery of overall delivery

The overall demand for Xilinx is low, XCF series PROM have been stopped production. But customer needs is still exist, and the market price has increased slightly. The overall lead time of Xilinx has gradually recovered, although the lead time of the 6S series still not improved.

Two new products:XA AU10P and XAAU15P FPGA, have been added into the automotive-grade XA Artix UltraScale+ family. These two products has optimized for advanced driver assistance system (ADAS) sensor applications.

Onsemi: Demand is concentrated in automotive and industrial products.

Onsemi's demand is focused on automotive and industrial products such as the NCV series and SZ series. The delivery time for automotive series remaining above 40-50 weeks, without much improvement. And the delivery time for FSV series also very long, about 50 weeks, the market prices remain high.

HassaneEl-Khoury, president and CEO of ON Semiconductor, said that ON Semiconductor’s biggest revenue growth in 2023 will come from the growth of silicon carbide in the new energy automotive market. On September 2022, ON Semiconductor finished its expanded SiC plant in Roznov, Czech Republic, which will gradually increase its production capacity of 16 times over the next 2 years. Up to now, ON Semiconductor has invested more than $150 million, and will continue to incest $300 million by the end of 2023.

ST

This year's automotive chip production capacity has been sold out at present, backlog order visibility of 18 months, of which the IGBT is still in tight supply. With the Infineon, STMicroelectronics and other international manufacturers end of the year price adjustment is expected to influence, the domestic orders continue to burst. Some manufacturers expect the supply and demand tension will continue to 2024-2025, and bluntly said that "customers want to lock the 2025 order".

According to Digitimes, the international power semiconductor giant Rohm plans to raise product prices from October 1, STMicroelectronics also has plans to raise industrial and automotive power device prices in Q4. STMicroelectronics pointed out that the next stage will focus on the development of industrial and automotive two segments, industrial and automotive is the business portfolio of the strongest growth momentum of the two markets, focus on promoting and focusing on these two high-growth market is the strategic direction in recent years, and also the key to reach the three-year company revenue of more than 20 billion U.S. dollars goal.